responsAbility's Asset Classes

Fund Investments

What are Fund Investments?

Investing into funds is an investment strategy wherein an investment manager invests in multiple other types of funds typically private equity-, private debt-, mezzanine finance- or other funds. This multi-layered investment approach enables investors to access a broad range of assets and strategies, including those that might be beyond reach for individual investors due to high minimum investment requirements or limited access. The diversification offered by investing into funds is twofold. Firstly, it diversifies across asset classes, reducing the impact of volatility in any single market or sector. Secondly, it benefits from the diverse expertise of various fund managers, each specializing in different investment strategies and markets. Spreading investments among multiple funds reduces risks and enhances potential returns, while also benefiting from professional management at multiple levels.

Our Fund Investments Approach

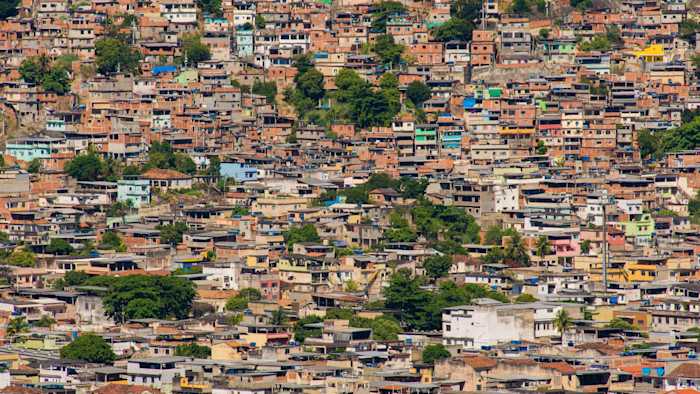

Our Fund Investments approach is tailored to capture growth opportunities in emerging markets. It is characterized by a diversified investment strategy that spans various geographies, vintages, strategies, and stages, aiming to reduce volatility and risk while targeting market rate returns. Our experienced team focuses on selecting top-performing fund managers, with an emphasis on consumer mid-market private equity and late-stage venture capital funds. Our investment portfolio includes primary fund investments, secondary fund investments, and co-investments.

Central to our approach is the integration of an ESG (Environmental, Social and Governance) and Impact (ESGI) strategy, which includes thorough ESG and Climate Assessments, Impact Assessment, and diligent Monitoring and Reporting. This strategy aligns with the EU Sustainable Finance Disclosure Regulation (SFDR), ensuring that our fund investments are not only financially sound but also environmentally sustainable and socially responsible.

Meet our Fund Investing Leadership Team

Michael Fiebig

Head of Private Equity & Funds. Member of the Executive Management

Ralph Keitel

Head of Fund Investments

Severin Fries

Head of Finance & Operations, Fund Investments

Corianne Van Veen

Senior ESG & Impact Officer

Christina Meyer

Head of Legal Investments Equity

Anthony Njoroge

Principal and Co-Head of Africa and Latin America, Fund Investments

Thomas Walenta

Principal and Co-Head of Asia-Pacific and Europe, Fund Investments

Felix Knidlberger

Principal and Co-head Africa and Latin America, Fund Investments

Kenneth Chin

Principal and Co-Head of Asia-Pacific and Europe, Fund Investments

Fund Investments and Impact

Investing into funds is instrumental in amplifying the reach and effectiveness of impact investing. By leveraging its unique position, Fund Investments can address critical needs in various sectors, driving substantial environmental and social change:

Scalability of Impact: Through pooling of resources, Fund Investments can provide substantial capital to impact funds, which in turn can scale their operations and increase their impact. This scalability is particularly important in sectors where large capital injections are needed for significant change.

Diversification Across Impact Themes: Fund Investments can invest in a variety of funds, each with a focus on different impact themes such as renewable energy, sustainable agriculture, healthcare, education, and financial inclusion. This diversification allows investors to contribute to multiple impact areas, spreading the positive effects across various sectors and geographies.

Access to Specialized Funds: Many impact investment opportunities are available through specialized funds that might be inaccessible to individual investors due to high minimum investment requirements or limited knowledge. These funds can for example be specialized in a sector, or in a geography such as lower income markets. Investing into funds can aggregate capital from multiple investors, enabling access to these specialized funds and thus broadening the impact investment landscape.

Risk Mitigation: Private capital investments can involve unique risks, including market, regulatory, environmental, social and governance and execution risks, especially in emerging markets. By investing into funds these risks can be monitored and managed ‘on the ground’, where also value can be added. In this way Fund Investments can mitigate these risks, making private capital investments more palatable for a broader range of investors.

Long-term Commitment: Impact investments often require a longer-term commitment to realize substantial environmental or social outcomes Investing into funds with their diversified and balanced portfolios typically stay invested for the longer-term, thus aligning with the time horizon needed for these investments to achieve their impact objectives.

Our Fund Investing Mandates

Swiss Investment Fund for Emerging Markets (SIFEM)

SIFEM, the Swiss Investment Fund for Emerging Markets, serves as Switzerland’s Development Finance Institution (DFI). Established in 2011 as a public limited company fully owned by the Swiss Confederation, SIFEM plays a key role in Switzerland's international cooperation strategy. SIFEM provides long-term financing to small and medium-sized enterprises (SMEs) in developing and emerging countries through local financial intermediaries. By doing so, SIFEM aims to reduce poverty while fostering sustainable, inclusive, and resilient economies. Its focus also extends to tackling the root causes of climate change and enhancing communities' resilience to its effects. responsAbility has taken over SIFEM portfolio management on March 1st 2023