responsAbility's Asset Classes

Private Equity

What is Private Equity?

Private equity is a form of investment where funds are directly invested into private companies. Private equity is regarded as an alternative investment, falling outside the traditional categories of stocks, bonds, and cash. Private equity provides investors with the opportunity to diversify their investment portfolios away from conventional asset classes. Typically, it exhibits a lower correlation with public markets, which can contribute to reducing total portfolio risk and potentially boosting returns. Private equity investors often seek to actively influence the management and operations of the companies in which they invest, with the aim of increasing the value of the companies and, consequently, their investment returns.

Meet our Private Equity Leadership Team

Private Equity and Impact

Private equity plays a pivotal role in impact investing as an asset class. It offers investors the unique opportunity to drive substantial social and environmental change by taking a shareholder position in impactful businesses, while generating attractive financial returns.

Unlike public markets, private equity offers investors the opportunity to directly invest capital into companies, allowing them to exert considerable influence over strategic decisions, including steering companies towards more sustainable and responsible practices. Private equity can be used to target and fuel growth opportunities in innovative solutions to social and environmental challenges.

The longer-term investment horizon of private equity is well-aligned with the nature of impact investing. Transformative changes in sustainability and societal impact require investors willing to take equity risk in exchange for a suitable financial upside. They must also be prepared to actively deliver value-add to investees via the governance structures of the respective businesses. As an impact-driven private equity investor, we work closely with company management to drive impactful business growth and to develop and implement robust Environmental, Social, and Governance (ESG) systems that are deeply integrated into the business model fabric.

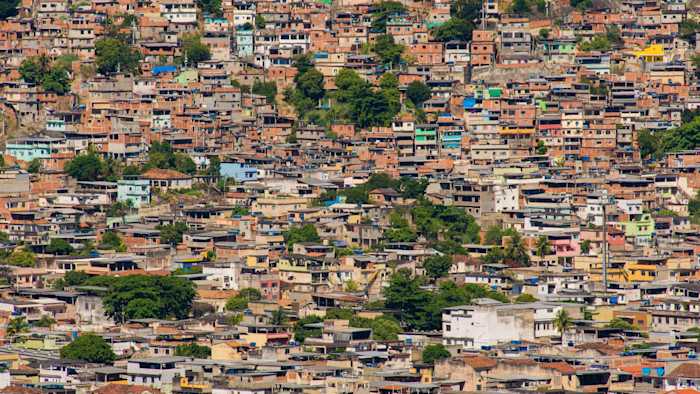

At responsAbility, we have built a strong track record in thematic private equity, with expertise in financial inclusion, sustainable food and climate-related business models in emerging markets. Furthermore, we manage a diverse range of fund of fund strategies focused on private equity funds across a wide array of strategies, addressing different impact dimensions and covering a broad range of emerging market geographies.