Sustainable investments

Blended finance for more sustainable portfolios

Stephanie Bilo, Chief Clients & Investment Solutions Officer, explains how impact investing with a safety net can provide institutional investors with access to new growth markets.

Sustainable investments have clearly entered the mainstream. One consequence of this is the increasing demand for impact investments – investments that are not only financially attractive but also actively aim to have a positive impact. They relate directly to the United Nations’ 17 Sustainable Development Goals (SDGs) and offer investors access to new investment themes, growth markets and opportunities for diversification.

A slightly abridged version of this article was published on 14 March 2020 by Swiss business newspaper Finanz und Wirtschaft in their editorial supplement "Institutional Investment".

Stephanie Bilo is Chief Clients & Investment Solutions Officer and member of the Executive Management at responsAbility Investments, a leading impact asset manager with a 17-year track record. Since 2003, responsAbility-managed funds have invested over USD 10 bn in developing countries.

PROVEN SOLUTIONS – AND NEW INITIATIVES

As always, investors tend to initially react with caution to emerging trends: Which products are suitable for their portfolio? How should the risk/return profiles of the investment solutions be assessed? Microfinance investments are one example for classic impact investments with a 20-year track record. They aim at financial inclusion, access to essential financial services for the lowest income groups – mostly women – in emerging markets, a basic prerequisite for sustainable development according to the World Bank. The topic is primarily investible via relatively liquid private debt funds that fit well into portfolios of pension funds or insurance companies, as they are practically uncorrelated with traditional or alternative asset classes.

Micro- and SME Finance for your portfolio INVESTMENT SOLUTIONS

In addition to this proven investment opportunity which offers a fairly conservative risk/return profile, new impact investing themes are increasingly emerging. Many of these are geared towards the issue of climate change and aim at untapped investment universes. Blended finance investment solutions are an interesting entry ticket for institutional investors interested in these topics.

HOW DOES BLENDED FINANCE WORK?

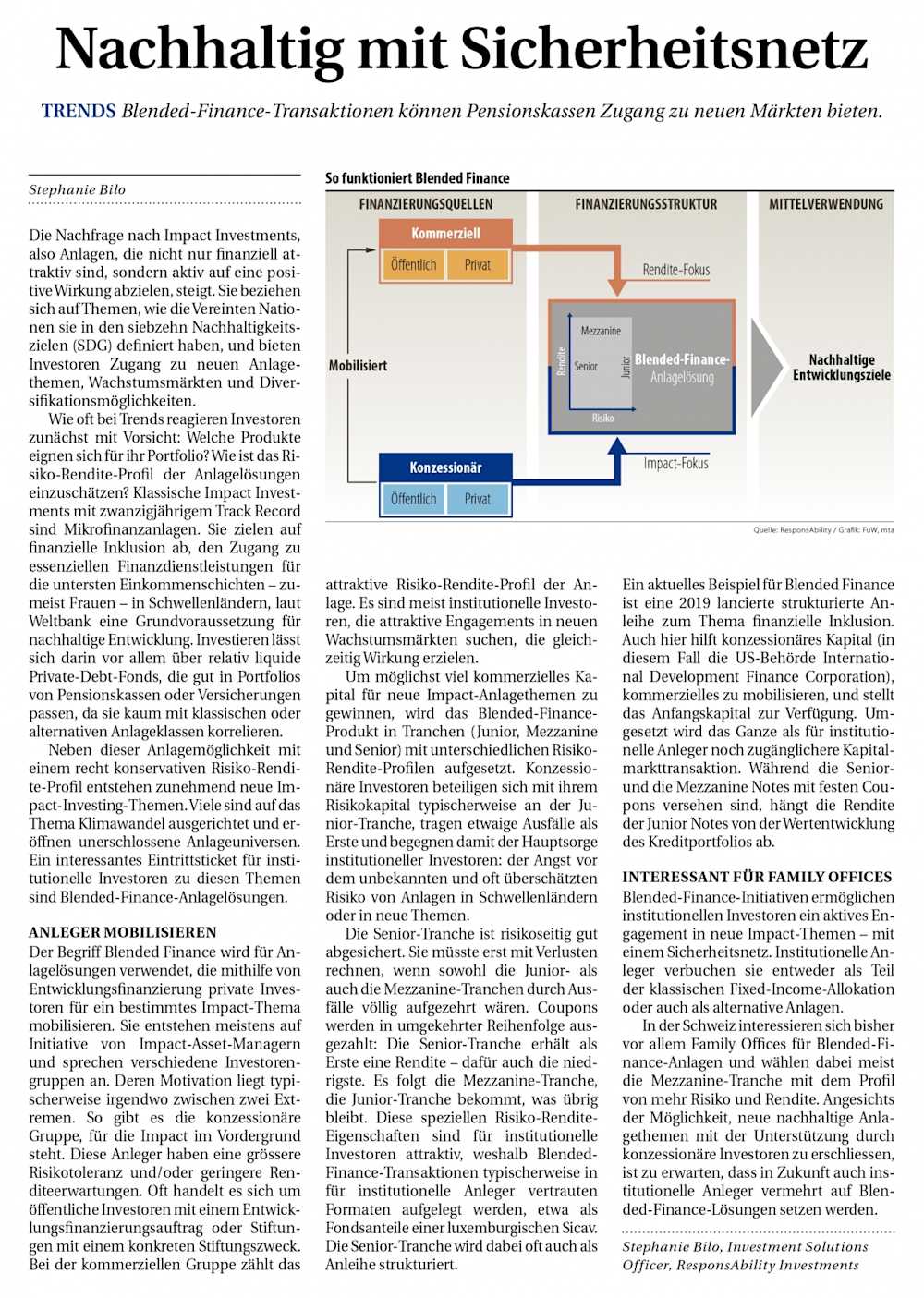

Blended Finance: Non-commercial investors use their risk capital to make new impact investment themes investible for institutional investors

The term blended finance is used for investment solutions that use concessional capital such as development finance to mobilise private investors for a specific impact theme. They are created, for example, on the initiative of impact asset managers such as responsAbility, and aim to attract different investor groups to new investment themes. These investors’ motivation typically lies somewhere between two extremes:

Concessional: Impact is key. Investors – often public investors with a development financing mandate or foundations with a specific purpose – have either a greater risk tolerance and/or lower return expectations.

Commercial: Investors – mostly institutional – are predominantly looking for attractive risk-return profiles while welcoming access to new high-impact growth markets.

To attract as much commercial capital as possible for new impact investment themes, the blended finance investment product is set up in tranches (junior, mezzanine and senior) with different risk-return profiles. Concessionary investors typically participate with their risk capital in the junior tranche, bearing any defaults first and thus addressing the main concern of institutional investors: the fear of the unknown and often greatly overestimated risk of investing in emerging markets or new investment themes.

The senior tranche is well hedged on the risk side: it would only have to expect losses if both the junior and mezzanine tranches were completely eaten up by defaults. Yields or coupons are paid out in reverse order: the senior tranche is the first to receive a yield - but also the lowest. The mezzanine tranche follows, the junior tranche receives what is left over. These special risk-return characteristics are attractive to institutional investors, which is why blended finance transactions are typically launched in formats familiar to institutional investors, for example as fund units of a Luxembourg SICAV. The senior tranche is often also structured as a bond.

Our climate fund with a 10-year track record MORE ABOUT THE FUND

The ten-year track record of a climate fund in the responsAbility portfolio shows that such blended finance models work: established in 2009 at the initiative of the German government, the Fund aims to combat climate change in developing countries. Today, 32% of the Fund's capital comes from commercial investors, who benefit from 68% risk coverage through concessionary investors.

“32% of the Fund's capital comes from commercial investors, who benefit from 68% risk coverage through concessionary investors.”

Stephanie Bilo

Another innovative example is a structured bond launched by responsAbility in 2019 on the topic of financial inclusion, which has been met with great interest in the market. In this structure, too, concessionary capital helped to mobilize commercial capital. The US International Development Finance Corporation (formerly OPIC) provided the necessary initial capital and the structure was implemented as a capital market transaction, making it even more accessible to institutional investors. While the senior and mezzanine notes had fixed coupons, the yield of the junior notes depended on the performance of the loan portfolio.

Public partners offering a safety net

Blended finance initiatives such as those mentioned above enable institutional investors to actively engage in new impact topics – with a safety net. Institutional investors book them either as part of the classic fixed-income allocation or as alternative investments. In Switzerland, family offices have so far been particularly interested in blended finance investments, usually choosing the mezzanine sector with a higher risk/return profile. However, given the possibility of developing new sustainable investment themes with the support of concessionary investors, it is to be expected that institutional investors will also increasingly rely on blended finance solutions in the future.