Aftershocks and resilience: Emerging Markets withstand global banking tremors

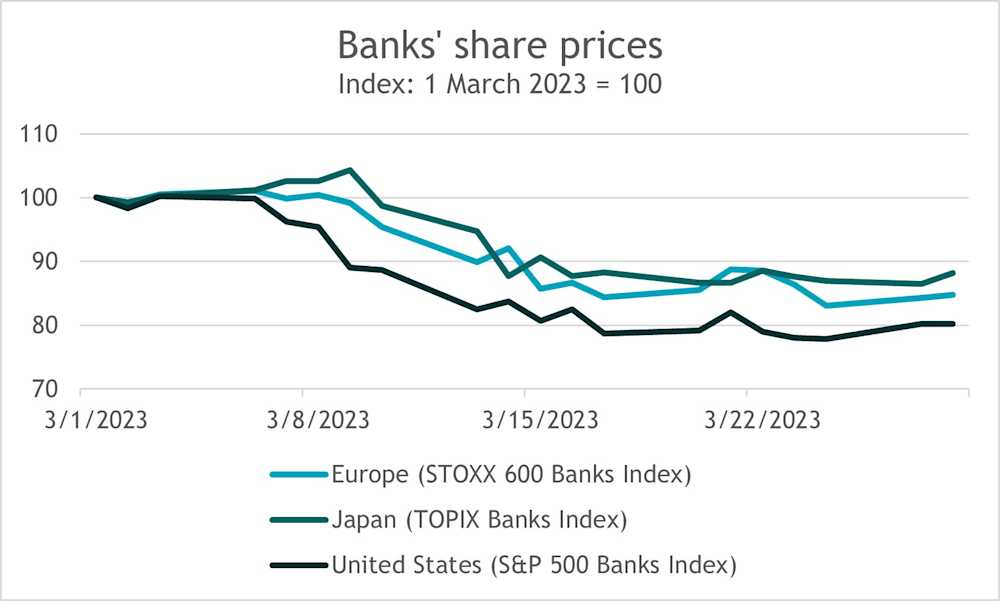

Recent weeks have been tumultuous for global banking. What started in early March with the second and third largest bank failures in US history, Silicon Valley Bank (SVB) and Signature Bank respectively, continued to add pressure to further US banks, not least Silvergate Bank, and culminated on 19 March in an engineered takeover of Credit Suisse, one of 30 global systematically important banks. Over that period, share prices of banks have dropped substantially, leading to bank indices recording declines of 16% (Europe, Stoxx 600 banks) to 18% (US, S&Ps 500 banks). Regulators took important action, closing some US banks, providing ample liquidity, reassuring depositors and, in the case of Credit Suisse, engineering the takeover by UBS.

Recent bank failures: idiosyncratic or systemic

The big question remains: Is this is a series of idiosyncratic and containable issues, or are these signs of more profound problems that ultimately pose risks to financial stability? And if the latter is the case: has regulatory action to date been sufficient to restore confidence? The answer is: it is too soon to tell, events still being very recent. New information and dynamics can unfold any time.

What is clear is that confidence in global banking systems has suffered. These events suggest that banks might be less well regulated and more vulnerable than previously thought. Also, the steepest rate hiking cycle in decades might cause more harm than previously anticipated, not least through, partially unrealized, losses on bond portfolios.

That said, there are a couple of elements that give comfort. For instance, a consensus is building that the key issues that made forementioned institutions fall, mainly bad management practices as well as substantial exposure to tech and duration risks, are more idiosyncratic than systemic. While many banks in Developed Markets (DMs) have unrealized losses on bond holdings, these losses can easily be quantified, eliminating uncertainty about the underlying value of assets. This contrasts with the Global Financial Crisis, during which the value of mortgages packed into mortgage-backed securities (MBS) was extremely difficult to ascertain. Taking unrealized losses on bond holdings into account, capitalization ratios of most banks remain comfortably above regulatory minima, as few banks assumed as much duration risk as Silicon Valley Bank. In terms of liquidity pressures, central banks are generally well positioned to address the issue, given their long-established facilities that allow banks to obtain cash against collateral.

Potential global economic impact of recent bank failures

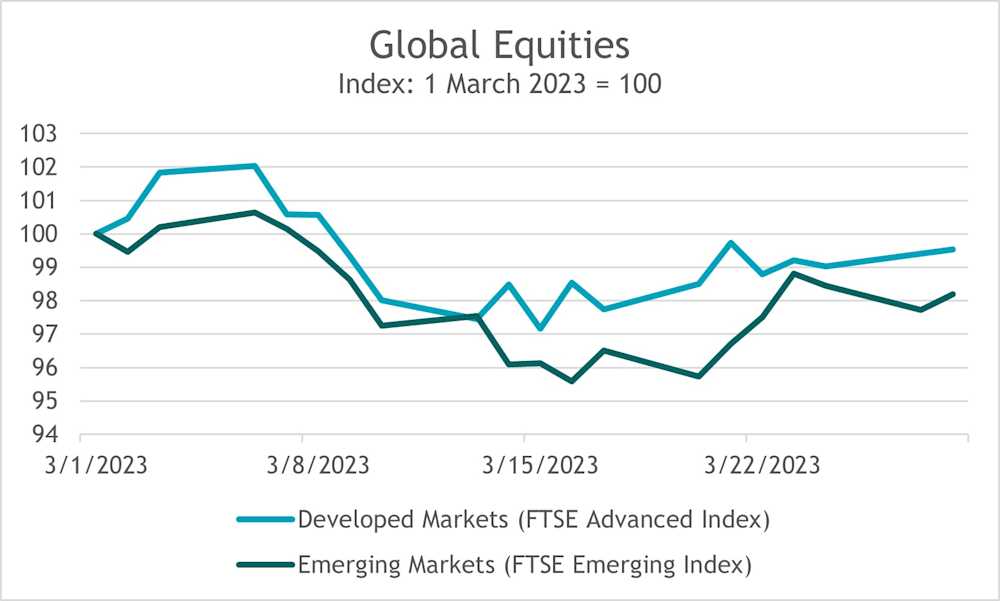

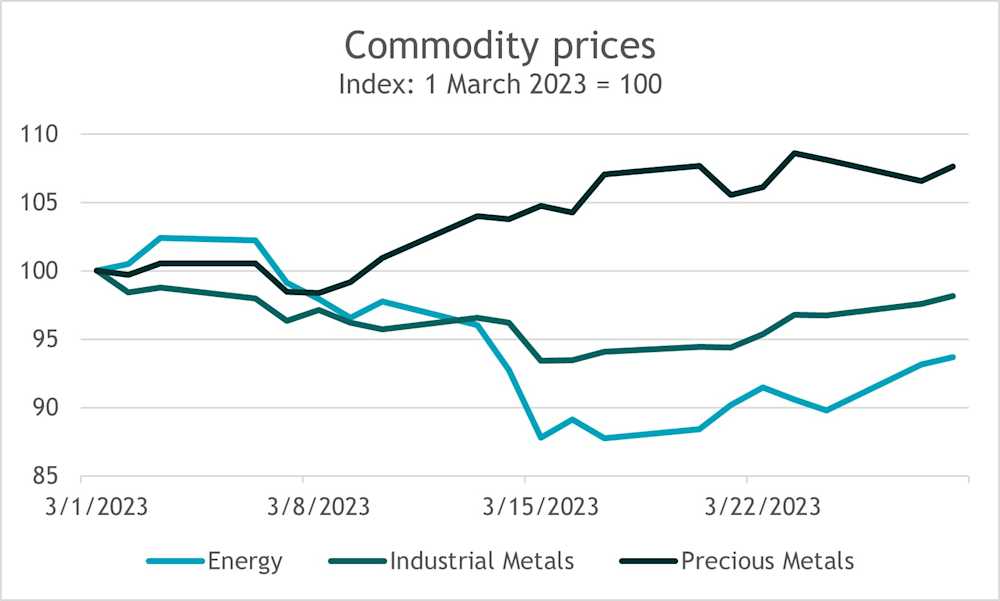

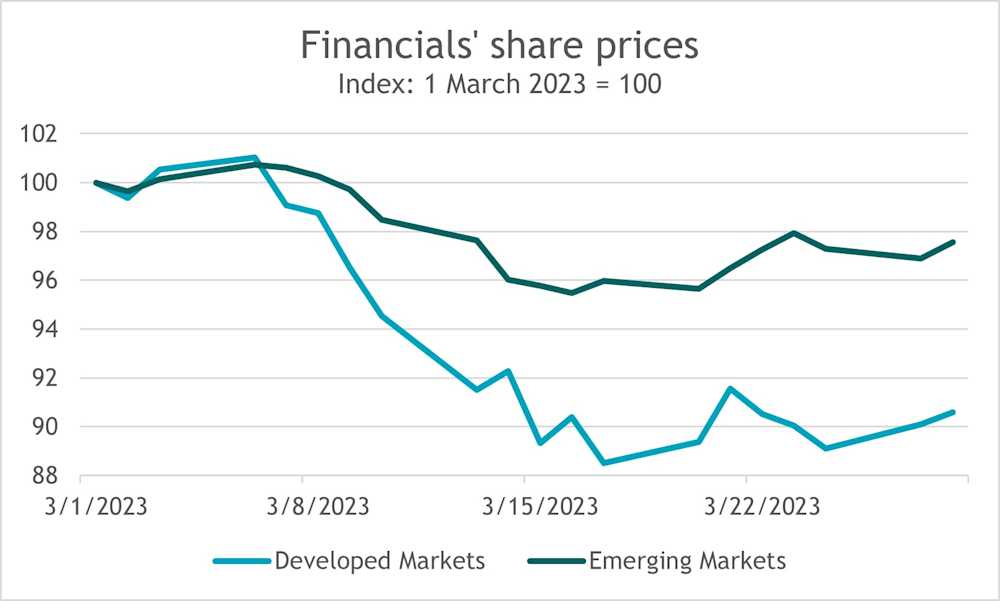

As for the broader economic impact of the banking sector turmoil, the signals from global markets are mixed. In the commodity space, drops in prices for energy, industrial metals and a small rally in precious metals are indicative of some hit to economic activity. Global equities however have held up reasonably well, mainly being dragged down by share prices of financial institutions as well as energy and mining companies, suggesting that overall headwinds to corporate earnings should be manageable. We also get reassuring signals from central banks that, despite recent developments, continue their tightening cycle of 50bps hikes by the the European Central Bank (ECB) and the Swiss National Bank (SNB) and a 25 bps hike by the US Federal Reserve (Fed).

Spillover risks to Emerging Markets

And where does this leave emerging markets (EMs)? In the absence of important direct exposures to failed DM banks, there are four broad transmission channels that need to be considered: confidence in banks, tighter external funding conditions, shifts in terms-of-trade and a potential weakening of external demand from developed markets (DMs).

Confidence in banks

Recent events serve as a reminder that banks actually do fail at times and will induce depositors and market participants to screen banks for similar risks that brought troubled banks down. While some issues were clearly institution specific (Credit Suisse), SVB’s collapse highlights the risk of unrealized losses on bond holdings combined with concentration risks in deposits. Generally, these risks are not deemed high in EMs, as banks don’t hold overly large bond portfolios that hardly contain long duration assets. As such, most banks have not been susceptible to large losses on bond portfolios caused by the large shift in yields over the past year. Additional, at least rated banks mostly have stable funding and ample liquidity according to Moody’s.1 Summarized, “banking sectors across EMs look strong” according to Capital Economics,2 with EMs being “for once a relative safe haven” and having “fewer banking sector vulnerabilities” stated by Oxford Economics.3 That conclusion is echoed by markets, as bank share prices in EMs have experienced a smaller decline of less than 3% since early March compared to those in DMs at approximately 10%. That said, even if EMs’ banks are relatively well positioned, EMs economies still risk facing negative spillovers from DMs through other channels.

Tighter external funding conditions

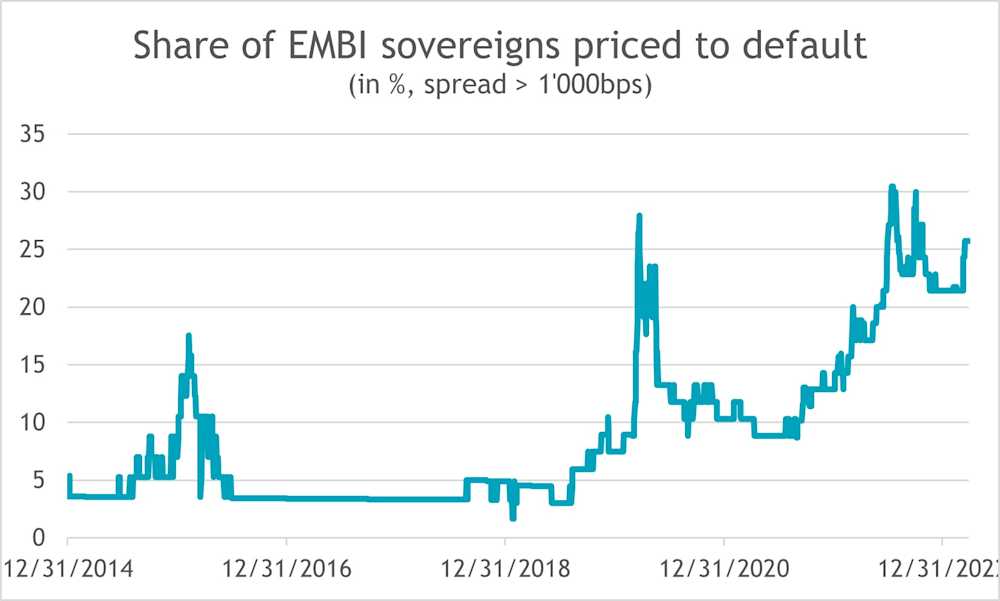

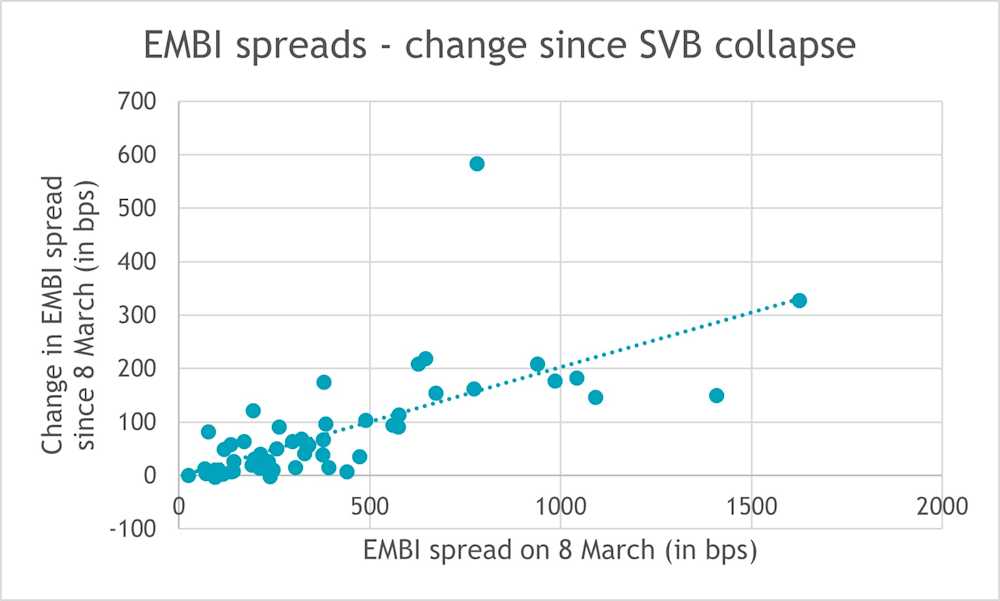

Another transmission mechanism is through tighter external funding conditions, as market participants become more risk-averse and shun risky assets. Since the beginning of March, many EMs have indeed seen credit spreads widen. In the grand scheme of things, though, funding conditions were already tight for weaker sovereigns before. Recent developments have merely accentuated patterns at the margin, with recent spread-widening being positively correlated to the initial spread. The share of sovereigns (included in JPM’s Emerging Markets Bond Index, EMBI) priced to default for instance has merely increased somewhat from an already previously high level. Consequently, recent developments have not changed the picture fundamentally.

Shifts in terms-of-trade

As initially mentioned, commodity prices have moved significantly over the months. If banking sector turmoil in DMs were to accentuate further, prices of energy and industrial metals would likely come under further pressure. As such, EMs risk seeing larger swings in their terms-of-trade, hurting major commodity exporters, and benefitting importers. Typically, declines in commodity prices create more winners than losers. Furthermore, declines happen from rather elevated levels, which should make them digestible even for the losers. And last but not least, in a world that struggles with containing inflation, declining commodity prices would actually be welcome, as it helps inflation return towards target. So overall, shifts in terms-of-trade should not pose major risks for most EMs.

External demand from DMs

Lastly, the question remains whether EMs will be faced with a drop in external demand, be it in commodities or manufactured products. For that to happen, growth dynamics would need to cool substantially in DMs in response to recent banking turmoil. This is currently not the base case. For the US, for example, Moody’s believes that “the broader economic and financial impact of these events will be limited given the size and diversity of the US economy.”4

Conclusion

To date, global banking turmoil seems to be contained thanks to decisive action by regulators and central banks, and EMs escaped the turbulence with limited spillovers. If things were to worsen substantially, the key transmission to EMs would likely come through tighter external funding conditions. Markets with pre-existing external vulnerabilities would be most affected, accentuating their need for international assistance. A vast spectrum of EMs though should continue to do relatively well and offer ample business opportunities.

1 See Moody’s sector comments on banks in Africa (“Risks of realising bond losses is low given solid liquidity and stable deposit bases”, 16.03.2023), Asia-Pacific (“Structural factors will limit impact of US bank failures”, 14.03.2023), CIS (“CIS banks are largely resilient to the recent events in the US”, 17.03.2023), and Latin America (“Contagion effect of US bank closures will be limited for LatAm banks”, 15.03.2023).

2Capital Economics: “EM banks: revisiting credit risks”, 21.03.2023

3Oxford Economics: “Global bank sell-off focuses on balance sheet vulnerabilities”, 15.03.2023

4 See Moody’s sector comment «Policymakers have responded promptly to bank stress but spillover risk is rising”, 22 March 2023

Philipp Waeber

Philipp Waeber is responsAbility’s Chief Economist. With 15 years of experience in macroeconomic analysis, he has a wealth of experience in assessing major contextual risks to our investments and guides investment decisions in challenging markets. While often working on specific countries, he keeps the bigger picture in mind and occasionally writes about it, as in the article above. Philipp has a bilingual master’s degree in economics and is a Chartered Financial Analyst (CFA) charterholder.