Innovative climate finance

Disrupting the financial world!

In its quest for innovative IT solutions that make it ever easier for banks to introduce green loans, the responsAbility-managed climate fund presented its own challenge at the F10 FinTech Hackathon held in Zurich in March 2019. The promise: transfer business ideas into prototypes within 48 hours.

The motivation

The responsAbility-managed climate fund is all about investing to help emerging economies go greener. To achieve this, the fund aims to convince local banks to take up green lending. While many are intrigued by the potential, quite a few feel intimidated by the technology hurdle they fear stands between them and the business opportunity. The answer: Introduce clever IT solutions that make green lending a piece of cake. One innovative way to obtain such solutions is by accessing talent through a Hackathon!

The idea behind a hackathon

An event, typically lasting several days, in which a large number of people meet to engage in collaborative computer programming

Companies pose a challenge: a problem they want solved

Interdisciplinary teams (techies, business, lateral thinkers etc.) elaborate an idea and develop a prototype

Following the event, the company can ask the team to further develop the initial idea

The climate fund’s challenge

Promote green growth in developing economies

The growing purchasing power in developing countries is allowing consumers to increase their living standards. Buying home appliances or private means of transportation is one of their first purchasing priorities. The increased energy demand associated with these consumption patterns exacerbates the effects on climate change.

Climate investing in emerging economies The fund

Even with more and more funding available for climate investments, the lack of consumer awareness on the benefits of cleaner technologies limits green economic growth. Providing timely and accurate information on economic and carbon savings is critical for greener purchases for which consumers then can access climate funds. We invite you to develop a solution allowing consumers, financial institutions and climate funds to accelerate financing of green technologies. Let’s mitigate climate change together!

The contestants

Two groups took up the challenge and, in the course of 48 hours, elaborated on their respective ideas.

Group 2 – second place:

Came up with a tool that helps banks to report on carbon emissions very much in line with what the fund is using at this point.

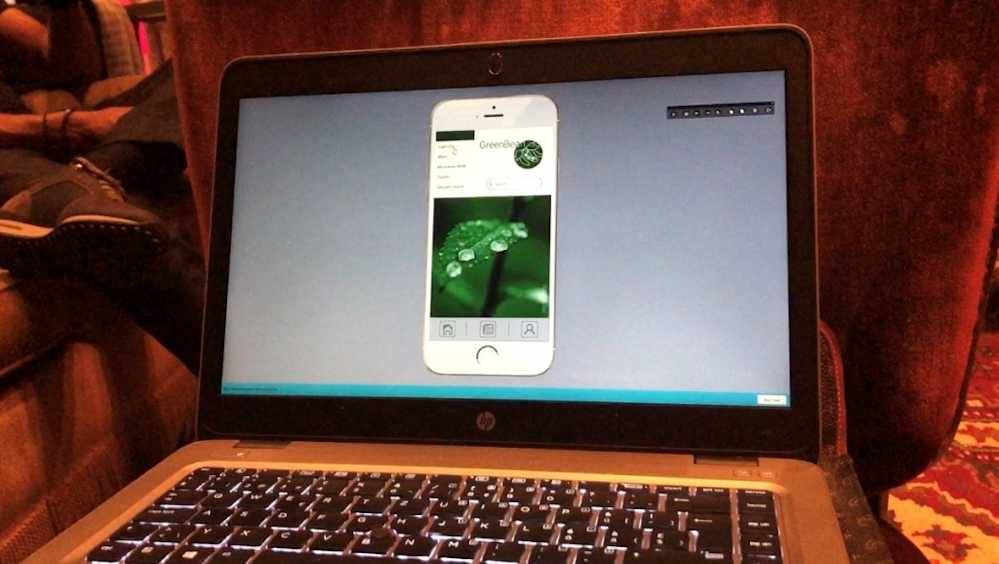

Group “GreenBean” – winner of the challenge:

Introduced an app that allows end clients to check electrical appliances for energy efficiency on the shop floor to encourage them to buy the best and most cost-efficient product in the long term and to request a green loan from their bank in the same process

Members (from left): Onur Karaağaç, Tijana Wekker, Samantha Zoppi, Nicola Stojkov and Peter Sykes

The process

“It’s amazing what is possible within 48 hours”

Roland Pfeuti, Head Investments at responsAbility and juror for the business solutions, on the experience of witnessing his first hackathon

“You get solutions within 48 hours!”

David Mazaira, Carbon Impact Specialist with responsAbility, on why he thinks participating in this Hackathon was well worth the team’s time

The result

At the end of this two-day (and night!) exercise, the climate fund’s team is pleased to say: The exercise has been a success!

One team confirmed the approach we have already taken for carbon reporting

We have one new idea that we will be taking further

Interested in investing? Fund facts

“One team has captured all we needed and provided an amazing solution which we would like to work on in the future.”

Eva Tschannen, Head Technical Assistance at responsAbility, on the result of the challenge