ESG briefing

ESG: the basis of sustainable investment

As an impact investment firm, we talk a lot about sustainable investing as regards the positive impact of our investments. But in the broader sphere, the discussion in mainly around ESG. So what is the difference between ‘Impact’ and ‘ESG’?

‘Impact’ refers to the activities or services provided by portfolio companies that create positive outcomes, such as access to financial services for low-income populations. ‘ESG’, which stands for Environmental, Social & Governance, is an assessment or a process to avoid negative consequences. By applying both of these approaches (Impact and ESG), we take a holistic approach that ensures all our investments generate positive impact while doing no harm.

As ESG is the basis of sustainable investing and a big part of the global discussion, let’s dive a little deeper into ESG and what it means in today’s investing climate.

ESG: what it means for us

For some investors, ESG is just a simple exclusion exercise (i.e. not investing in certain harmful sectors such as fossil fuels or tobacco). However, we believe ESG goes far beyond this: it is a systematic process that ensures that investments don’t have negative issues associated with them. Our ESG criteria are fully embedded in our investment process and our ESG due diligence allows us to identify potential negative practices or issues that might contradict universal human rights principles of a potential portfolio company (i.e. a microfinance institution that has no formal complaint process to enable employees to raise concerns). By identifying these issues and then engaging with the company to address them, we ensure that our investments only have positive consequences.

ESG in the financial sector: Outperforming conventional funds during the Covid-19 lock-down

The integration of a proper ESG framework has been proven to be beneficial, not only at responsAbility but also in the wider financial sector. Research shows that funds with a proper ESG framework tend to outperform non-ESG funds – both in the short-term and the long-term (See here and here). This fact is illustrated in figure 1, which shows that an ESG leading emerging market index has consistently provided better financial returns when compared to a conventional emerging market index.

Figure 1: ESG leading funds outperform conventional funds, according to the MSCI Emerging market index comparison (2019) - Source: Bloomberg.

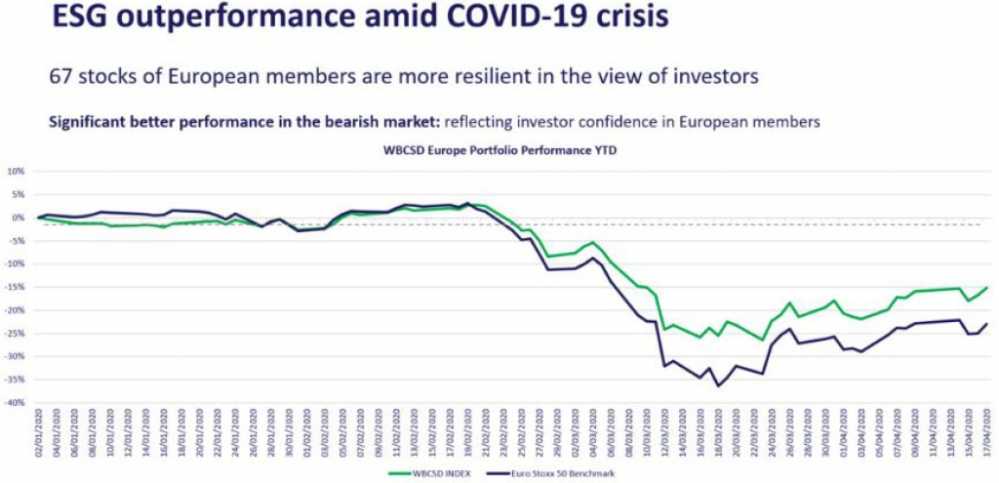

Companies that perform well on ESG factors tend to be more resilient, avoid financial penalties and legal actions, and have a better reputation. These are some of the many ESG factors that contribute positively to the growth of the company and its financial results. Even during the global coronavirus lockdown in 2020, ESG funds have shown statistically better performance compared to non-ESG focused funds (see figure 2 or here for more information).

Figure 2: WBCSD index funds -all with integrated ESG frameworks- outperform conventional funds and indexes during the COVID-19 crisis. Case study from WBCSD index and Euro Stoxx 50 Benchmark between 1/1-2020 and 17/4-2020. Data source: WBCSD.

This trend can be explained by the fact that companies with good labour practices are protecting their workforce during the challenging Covid-19 crisis, and are therefore more capable of maintaining the commitment to its workforce, which ensures additional support from its customers and the broader community around it.

ESG process and performance

Our ESG framework is aligned with the Performance Standards developed by the International Finance Corporation (IFC), the private sector arm of the World Bank Group. The framework consists of a set of indicators to screen potential investments, including factors on labour practices, environmental risks, community impacts, client protection, governance, etc.

After having screened our proposed investments against our exclusion list, a thorough due diligence process is conducted. If we find any negative aspects during our due diligence process, we either:

Engage with the portfolio company and request/help them to improve over time. In these cases, we develop an ESG Action Plan, which we regularly monitor in collaboration with the investees, to ensure that the investees improve on the identified aspects. For instance, if we invest in a company that has no formal Human Resources policies, we will require them to be implemented and then help develop and apply the HR policies necessary to protect its workforce.

If we identify more severe aspects, e.g. child labour, we will immediately stop the investment process and divest from such issues.

Because of our extensive work on helping our portfolio companies to improve on ESG related aspects, roughly 70% of all investments within the responsAbility portfolio score low on ESG risk. The remaining 30% of responsAbility’s portfolio is classified as ‘medium’ ESG risk.

In conclusion, ESG is certainly a core element for sustainable investment. But for true impact, one must go beyond ESG and avoiding negative consequences. This means targeting positive outcomes, such as setting targets for CO2 reduction, and measuring them to be sure that an investment is performing not only financially, but also performing as regards the desired impact of the investment. Therefore, for the sake of the planet, we hope that the next trending topic after ‘ESG investing’ is ‘Impact investing’. Only then can the full scope of sustainable investing be realized.

Pedro Fernández

Pedro Fernández is head of Impact and ESG at responsAbility, leading the evaluation and monitoring of ESG factors across responsAbility’s portfolio. Pedro holds a BSc in Environmental Sciences, an MSc in Health & Safety and is a certified auditor of the SA8000 standard on social issues. Pedro has 15+ years of experience in managing environmental and social risks and opportunities in various industries including climate change, community engagement, health & safety and labour conditions. He also holds an extensive track-record in managing projects in developing countries and in environmental hotspots.