Education, energy specialists and reporting are key

How-to: the recipe for green lending

Within many traditional financial institutions (FIs) across the globe, sustainability-minded employees are pushing their institution to be greener. Our climate experts started calling these employees “Green Champions” and engaging with them to help bring their institution into the green lending sphere. Over the years, the following “recipe” for green lending success emerged, with the goal to transform financial institutions, gain more “Green Champions”, and most importantly, mitigate climate change.

Step 1: Demonstrate how it’s done locally The demonstration effect cannot be underestimated, so from the beginning, we sought to create a network of partner institutions who could learn from each other. This way they could go from commiseration about the woefully under-priced cost of emitting carbon and other greenhouse gases (GHGs), the high levels of risk aversion and low awareness of the both the viability and the benefits of green investments, to solutions to overcome those hurdles together.

Next, as truly sustainable climate finance is only possible through the creation of locally driven initiatives, our climate team focused on building bridges between international best practices and local needs. One great example is the local market baseline. A question often asked by any institution contemplating climate finance is: “what is actually ‘green’ in my market?” So to ensure the accurate calculation of CO2 emissions savings, our climate team continuously develops representative technology- and country-specific baselines that allow measurement of the relative use of energy and/or CO2 savings of a new technology. After defining such baselines, they help the FI to identify the technologies that generate at least 20% energy savings or CO2 savings, while helping the FI to highlight these benefits in their marketing and promotional activities.

Step 2: Add Energy Specialists to the mix Energy Specialists provide on-demand support to partner institutions along the investment cycle and guide FIs in the implementation of green lending strategies. Based in the region they operate in (Mumbai, Vietnam, Tbilisi, Nairobi & Lima), they provide on the ground support to all of the local FI partners and bring in market knowledge and understanding of various green technologies and green lending approaches that enable FIs to successfully manage their green lending program. In case additional specialized expertise is required, Energy Specialists also facilitate the work of external experts hired by the Technical Assistance Facility (TA) in terms of managing the expectations of the FIs and coordinating activities in a way that fits with the bank’s capacities and priorities. Last but not least, Energy Specialists also document green lending efforts as case studies and share them among the global network of green lending partners to share ideas and outcomes that can help enable greater impact in other markets.

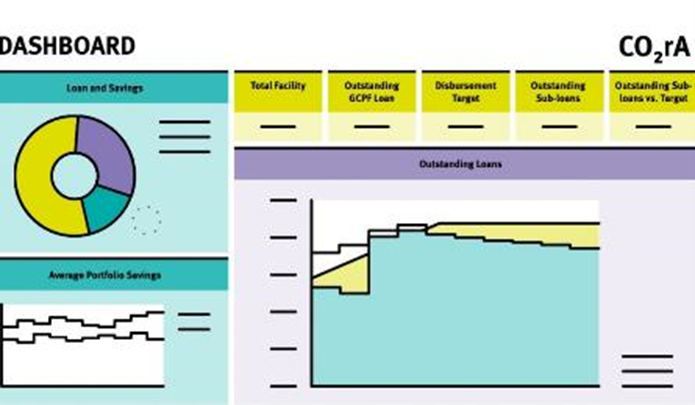

Step 3: Exact Measurement is key responsAbility has developed a proprietary software to account for carbon emissions reported by partner institutions. The tool has been customized for the type of FIs and projects financed by the climate fund. This carbon reporting tool, named CO2rA, is set up to meet the reporting requirements of investors and to ensure the eligibility of the loans given to end clients while minimising effort from the partners’ side.

Designed with a user-friendly interface, it offers our partners simplified reporting and immediate feedback on project eligibility. The software also tracks the performance targets considering the revolving nature of funding and gives the partners an overview of their portfolio, visualising CO2 emissions reductions and energy saved in various infographics.

CO2rA is regularly improved and has proven to be capable of capturing and computing the carbon savings of more than 80’000 sub-loans. CO2rA’s approach to CO2 savings calculations are in line with global reporting standards such as the GHG protocol and the IFI Framework for a Harmonised Approach to Greenhouse Gas Accounting.

Step 4: Education is the secret ingredient

Our climate team engages with its partner institutions to understand their capacities and challenges related to applying E&S (Environmental & Social) requirements in practice.

Awareness raising After analyzing the needs and requests from partner institutions, our TA Facility launched a variety of tools to build awareness and drive education to support the entire E&S process as well green lending in general. A great example is this video which was created as part of a series to raise awareness about the relevance of E&S risk management and is used for training events and also made available publicly.

Developing sector relevant tools In addition, our TA Facility hired a specialized firm to further assess the need for guidance tools. This assessment concluded that it is relevant to develop E&S risk management tools given the lack of adequate alternative resources.

One such tool is this online training and quiz for testing knowledge on how to apply an exclusion list: Take the quiz

Bespoke support for partner institutions In addition to these tools that are made available publicly, the climate team also engaged in 8 ongoing or newly approved TA funded projects to enhance E&S risk management capacities for individual partner institutions. The implementation of these projects was made possible by relying on local E&S experts or providing remote training support. One such example is the training for Banco Davivienda in El Salvador:

E&S risks represent a challenge that goes beyond investors and investees. An entire value chain can be impacted, which demands targeting the clients of Financial Institutions, such as local project developers. Aiming to continuously empower partner institutions when it comes to E&S risk management and opportunities, the TA Facility designed and rolled out a series of three virtual “training-of-trainer” sessions with Banco Davivienda in El Salvador. The main objective was to provide key staff (one E&S officer and two credit risk analysts) with the content and methodology to disseminate the know-how across the institution.

Key outcomes: building internal and external knowledge

15+ loan officers and credit analysts were trained in E&S client engagement: Following the 3 sessions, the three trainees became trainers and applied the knowledge recently acquired (content and methodology) to their peers.

Buy-in from Davivienda’s teams: The training was well received by the different teams and the trainers are now recognized for their knowledge not only on E&S risks, but also for their training capabilities.

Besides Davivienda’s staff, this training has also benefited the climate teams to better understand success factors for virtual collaboration and suitability for future workshops and events.

Read more in the climate fund Impact Report!