Impact blog

Impact blog: Hipsters aren’t enough to solve the climate crisis

The scale and scope of climate change are without parallel. It is all-consuming in every sense, affecting all points of the compass, from every country to every meal. Climate change is also urgent, yet the size of the problem, and its uneven progress, undermine comprehension. How can we be on the verge of a global crisis when the sun is shining, and the supermarkets are full? We need to halve emissions by 2030, but many seem to think we can do the ecological equivalent of doing our homework on the school bus.

So perhaps we should also frame the problem in the same context, or at least make it easier to digest. Take a class of ten primary school children, selected as a representative sample from around the world. Without action, by the time they reach my age, 6 will be exposed to extreme heatwaves on a regular basis, 3 will suffer from water scarcity and none will ever see a coral reef. Our actions now, not tomorrow, will decide whether their future is unforgivably different.

We need to halve emissions by 2030, but many seem to think we can do the ecological equivalent of doing our homework on the school bus.

Paul Hailey, Head of Impact

But even if it is a global issue, there are some important differences between these kids. On average, the two richest kids are producing almost as much emissions as the eight poorest – 45% of global carbon emissions. Understandably this is where much of the climate change discourse has focused – a critical part of the struggle involves the developed world making major changes to policies, lifestyles, infrastructure.

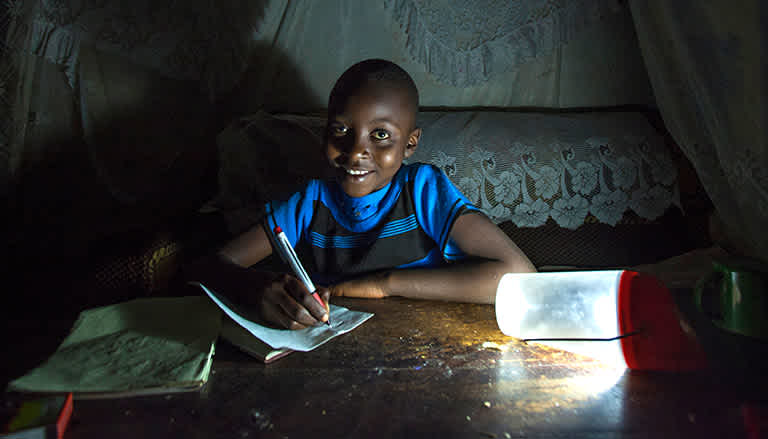

But it is also a mistake to focus on the two rich children exclusively. The “other eight” still represent 55% of carbon emissions, up from 33% 30 years ago. This percentage will increase further. Energy consumption in developing countries will rise by 84% by 2035, with economic and demographic expansion leading to a surge in greenhouse gas (GHG) emissions. Yet how can we deny the other eight the same quality of life and opportunities as us? Right now, three of our class live on less than $3.20 per day, one doesn’t have electricity and on average more than one is malnourished. We’re not talking about frivolous consumption here – if the developing world takes the conventional path to simply fulfilling essential needs like proper nutrition, access to energy, or access to clean water, this will boost emissions, no matter how many Europeans start eating vegan and travelling by train.

To achieve that growth while reducing emissions we must harness the power (literally and figuratively) of innovative, sustainable business models that generate clean power and improve efficiency. Some of this will come from large-scale, national projects, but mid-size hydro or wind power plants can still significantly increase power per capita in many developing countries. These projects provide a more reliable, cheaper, sustainable energy mix, boosting development in the process. For those areas where transmission networks are not in place or the existing supply is unreliable, a variety of off-grid solutions are available in many parts of rural Africa for low-income households and SMEs. As a result, it is still possible for local companies to provide electricity to families for the very first time and reduce emissions rather than increasing them.

Equally, a multitude of solutions now exist to boost energy efficiency in the developing world context. Providing loans to small businesses for more efficient machinery or insulation reduces their utility bills and limits emissions overall, sometimes in highly polluted urban environments. The agricultural sector is still crucial to many developing economies but is often both inefficient and a major source of CO2� and methane emissions. Helping local producers to build better storage and processing facilities, or more efficient irrigation systems, will increase revenues and reduce wastage.

Energy consumption in developing countries will rise by 84% by 2035, with economic and demographic expansion leading to a surge in greenhouse gas (GHG) emissions.

Paul Hailey, Head of Impact

Finding solutions for adaptation in the developing world is also critical. While all this class will suffer from the effects of climate change, the eight poorest come from backgrounds that make them much less able to cope with this change. Many developing countries simply don’t have the money or institutions to bring about change on the scale required. For some it may be too late – if one of our kids is from a small island state, their country may be sinking already.

However, none of this ‘gardening’ will happen without funding, and this is where we really see the difference between developed and developing countries. Overseas Development Aid from governments is falling, despite a USD 2.5 trillion gap in annual funding to reach the SDGs. There is a clear need, and opportunity for private investors here, but a combination of higher perceived risk and illiquid local capital markets (where they even exist) means that many emerging and frontier markets struggle to attract the long-term investment needed. As a result, asset managers and development agencies are banding together to create blended finance products. This is an innovative approach that typically allows public development agencies to assume some of the first losses, reducing the risk profile and catalysing private investment into key areas of development.

Nonetheless, this revolution must extend to the world of investment. At a time when Greta Thunberg, Alexandra Ocasio-Cortez and Climate Extinction have electrified public discourse, there is a clear demand for solutions among consumers and the wider public. The financial sector and asset owners must respond to this. The other eight have a right to the same quality of life as their counterparts in Europe or the US – providing them with a green path to development is the key to passing the biggest test of this generation.

Paul Hailey

Paul Hailey is Head of Sustainability and Impact at responsAbility Investments and the author of various publications and articles. Previous roles at the company include Senior Research Analyst for the financial sector. He has an MBA from École des Hautes Études Commerciales de Paris (HEC Paris), where he is also a lecturer, and a B.A. (Hons) from Pembroke College, University of Cambridge.