responsAbility's Asset Classes

Private Debt

What is Private Debt?

Private debt is a form of financing provided to borrowers by non-bank entities, offering an alternative for borrowers to traditional bank loans. Investors can invest in pools of private debt assets made available by a servicer or originator, usually in the form of funds or other investment products. Private debt is typically classified by investors as an alternative investment, as it does not fall into the conventional investment categories such as stocks, bonds, and cash, which are liquid or listed. Private debt provides investors with an opportunity to diversify their investment portfolios away from traditional asset classes. It tends to have a low correlation with public markets, which can help to optimise investment portfolios. For borrowers, accessing private debt brings the benefits – compared to traditional bank financing - of more flexible and tailored terms, structures, and conditions. For certain borrowers, such as microfinance institutions in certain markets or early-stage companies, private debt may be the only accessible form of financing, as banks do not offer credit to them at all.

Our Private Debt Approach

Tailor-made transactions

We have been sourcing and structuring private debt transactions since 2003. Our private debt funds provide investors with access to private market investments across various impact themes, offering robust returns, low volatility, and portfolio diversification. We focus on identifying and investing in high-potential companies and sectors that are crucial for economic and social development. All our private debt transactions are “hand-made”, meaning they are sourced, analysed, negotiated, implemented and monitored by responsAbility staff.

Rigorous Due Diligence & Market Embeddedness

Our approach is characterized by a thorough due diligence process, mostly carried out on the ground, based on local market understanding, detailed financial analysis as well as Environmental, Social, and Governance (ESG) risk assessment, and a rigorous assessment of impact principles.

Hands-on SME support

We provide hands-on support to our portfolio companies, helping them to enhance their operational efficiency, governance standards, and impact measurement practices. This hands-on approach ensures alignment with our impact objectives and provides additional value for our investees and investors.

Meet our Private Debt Leadership Team

Private Debt and Impact

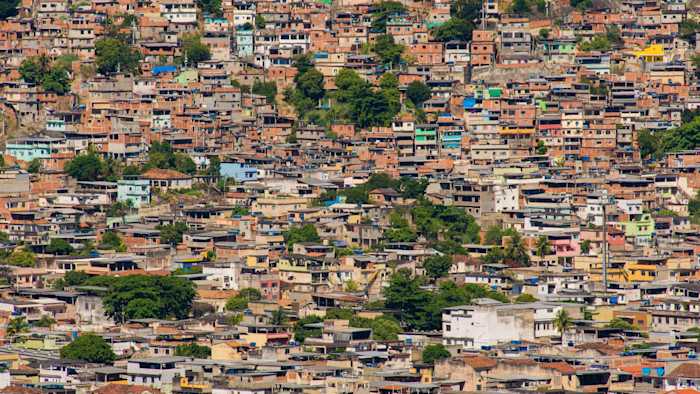

At responsAbility, we deploy private debt strategically to provide financing to enterprises and institutions selected for their substantial social or environmental impact stemming from their core business operations. The impact of these companies and institutions is far-reaching. For instance, microfinance institutions we support are instrumental in offering access to financial services to underserved communities, enhancing financial inclusion. Companies in the sustainable food sector contribute to rural job creation and income generation, thereby strengthening local economies. Furthermore, our climate finance investments in solar installation companies supports the development of low-carbon emission energy solutions, which align with the decarbonisation goals.

Private debt plays a significant role in impact investing due to its “additionality” – it often represents the crucial funding that a company or institution needs to carry out its impact-generating activity, which would not be attainable without that funding. In particular in emerging markets, private debt can address critical financing gaps for companies and institutions that often struggle to secure funding from traditional banking channels. Furthermore, private debt offers tailor-made and flexible financing solutions. Even for companies with access to bank financing, private debt is essential for expanding operations or financing specific projects that lack bank funding options. Finally, private debt financing facilitates direct engagement with the borrowing enterprise or institution allowing us to provide expertise, support, and feedback, thereby contributing to their success and impact in a hands-on way.