A Decade of Credit Shifts in Emerging Markets

The past decade (2014–2024) has been a stress test for emerging markets unlike any in recent memory. From the end of the commodity super cycle and shifts in US monetary policy, to a global pandemic and heightened geopolitical tensions, Emerging Markets and Developing Economies (EMDEs) have faced a relentless series of external shocks. Yet many economies found ways to adapt, stabilize, and keep growing.

For investors, these years underscored that emerging markets are not defined by volatility alone. They are diverse, dynamic, and increasingly transparent — with credit outcomes shaped as much by local reforms and institutions as by global forces. This makes selective, long-term investment all the more relevant.

These markets can be viewed not just through the lens of risk, but of potential: to deepen financial inclusion, build climate infrastructure, strengthen agricultural value chains, and help create a more sustainable, opportunity-rich world. Reviewing how sovereign risks have evolved over the past decade offers powerful insights into resilience, differentiation, and why we remain committed to mobilizing capital where it can make the greatest difference.

A shifting, but nuanced, sovereign credit landscape

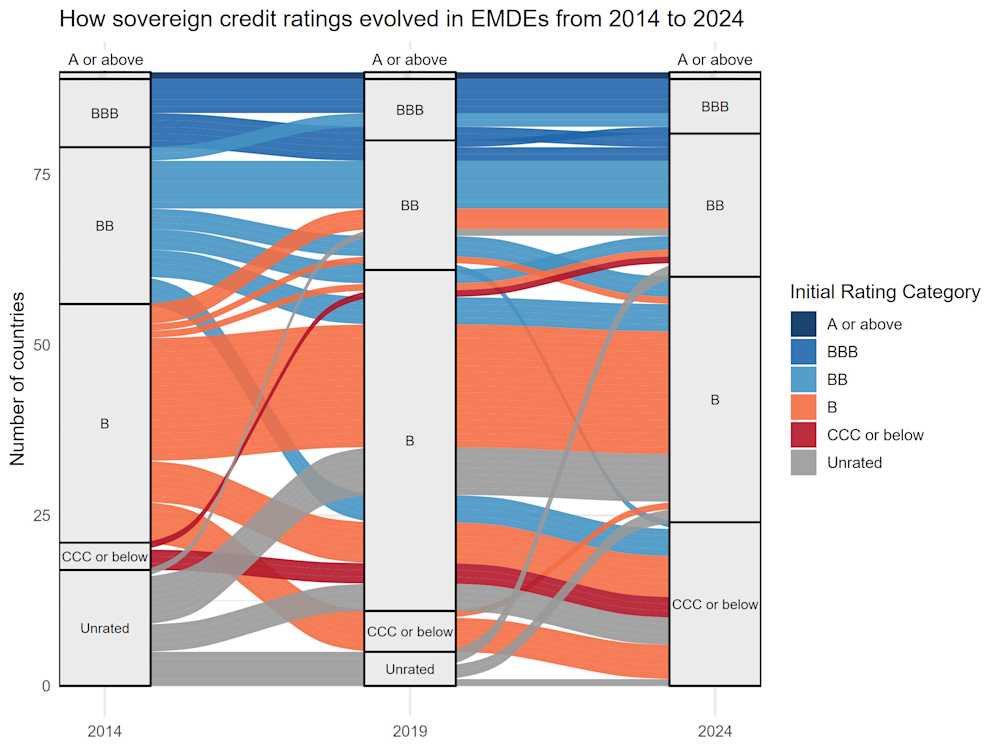

Looking back from 2014 to 2024, sovereign credit trajectories across EMDEs reveal a landscape of both vulnerability and resilience. In the first half of the decade, most ratings held steady amid broadly supportive global conditions. Many countries even obtained sovereign ratings for the first time, enhancing market transparency and providing valuable external assessments that we actively monitor. (see chart below)

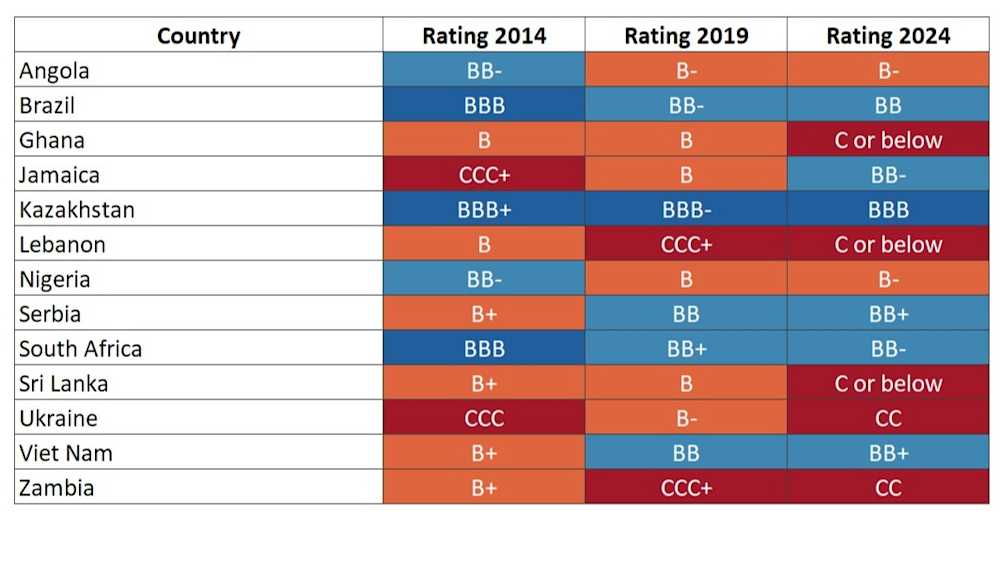

But beneath the surface, the sharp drop in commodity prices exposed fiscal and external weaknesses particularly in resource-dependent economies like Angola, Brazil, Kazakhstan, Nigeria and South Africa. The later years brought fresh challenges. The COVID-19 pandemic, supply disruptions, global inflation and a sharp tightening of US interest rates all tested EMDEs’ resilience. Debt burdens grew and geopolitical risks added to investor caution. Between 2019 and 2024, over 20 EMDEs saw rating declines of more than a notch. Taken as a whole, the decade has seen a net deterioration in sovereign credit profiles across EMDEs, with the 2024 map skewed more heavily toward lower ratings than in 2014. While this reflects the cumulative weight of global and domestic pressures, it also highlights how quickly perceived creditworthiness can shift—and why close monitoring of credit trajectories is essential. Given the extraordinary strains of the period, it was perhaps not surprising that some sovereigns—such as Ghana, Lebanon, Sri Lanka, Ukraine and Zambia—ultimately had to restructure their debt.

Lessons in resilience and differentiation

Yet these headline pressures mask a more differentiated picture—one that underlines why local policies, institutions, and reform paths matter so profoundly. Jamaica, for example, continued its remarkable multi-year credit recovery. Serbia and Vietnam also extended their positive momentum, illustrating how sound macroeconomic frameworks, credible reforms, and external support can help countries weather even turbulent global conditions and steadily improve their credit profiles.

These examples highlight that credit outcomes depend heavily on country-specific fundamentals. When looking across broader income groups, upper middle-income EMDEs, supported by deeper markets and more mature institutions, proved somewhat more resilient on average. Meanwhile, many lower middle-income countries faced the brunt of rating pressures, reflecting both debt vulnerabilities and sharper exposure to external financing shocks. Low-income countries, particularly in Sub-Saharan Africa, saw widespread downgrades, often tied to a combination of political instability, security challenges, and limited fiscal space.

For investors, the key takeaway is that EMDEs are far from homogenous. Diverse fundamentals and policy responses produce divergent credit paths—even under shared global stresses. It demonstrates why precisely assessing and pricing credit risks is essential to responsibly financing sustainable growth.

How responsAbility navigates these dynamics

Over the past two decades, our emerging market investment strategy has remained grounded in deep local expertise and disciplined risk assessment. Our investment portfolio’s weighted average sovereign rating has remained remarkably steady over the past ten years, improving marginally both between 2014–19 and 2019–24. It highlights how we navigate shifting landscapes—carefully managing risks while dynamically adjusting our country exposure to capture opportunities and mitigate risks that emerge from change. Furthermore, while some of our investments are closely linked to the macroeconomic environment—such as loans to financial institutions—others, like sustainable food and climate infrastructure, are not.

Importantly, our business is not about avoiding risks—it’s about understanding, pricing, and managing them. By operating across numerous transactions in diverse EMDE contexts, we’ve built robust methodologies for assessing creditworthiness, anticipating challenges, and partnering with borrowers to navigate uncertainty.

A more transparent, opportunity-rich future

One positive evolution over this period is the steady rise in market transparency. More EMDE sovereigns are now rated by international agencies than ever before, offering clearer benchmarks and better early warning signals for investors. Volatility is inherent to EMDEs, but it often creates opportunities to partner with strong businesses and price credit in a way that reflects both risks and growth potential.

The past decade has ultimately underscored that resilience is often underestimated. Many EMDEs have proven capable of adapting policies, maintaining growth, and attracting investment even amid repeated global headwinds.

At responsAbility, our vision is to mobilize capital and invest in emerging markets to help build a sustainable world with access to opportunities for all. In an environment where many EMDE sovereigns face tighter constraints, our investments—grounded in rigorous risk analysis and a long-term partnership approach—may be more vital than ever. It’s not just about managing credit shifts; it’s about helping shape a more inclusive, resilient future.

More on Emerging Markets

Philipp Waeber

Philipp Waeber is responsAbility’s Chief Economist. With 15 years of experience in macroeconomic analysis, he has a wealth of experience in assessing major contextual risks to our investments and guides investment decisions in challenging markets. While often working on specific countries, he keeps the bigger picture in mind and occasionally writes about it, as in the article above. Philipp has a bilingual master’s degree in economics and is a Chartered Financial Analyst (CFA) charterholder.