Climate Finance

Mobilizing Private Sector Capital to Scale Climate Action in Asia

In late 2023, we launched our USD 500 million Asia Climate Strategy, a blended investment approach designed for institutional investors to catalyze investment in high-impact sectors capable of significant CO₂ reduction across emerging Asia. While tackling climate change at a global level is essential, generating big wins early is crucial, as the cumulative build-up of greenhouse gases is what drives long-term climate change.

One of these big wins could be emerging and developing Asia, which currently contributes over 43% of global greenhouse gas emissions. Considering that Asia is home to 60% of the global population, this might not be surprising, but relative to the economic development stage and the region's global economic contribution, this number is alarmingly high. Asia's economies make up only about 32-35% of the global economy, meaning their emissions are disproportionately large for their economic size. This disparity is only set to grow, as emerging Asia, which consistently contributes around 50% to annual global GDP expansion, is poised for even faster growth in the coming years. These economies are just at the starting gates, and the urgency to decarbonize becomes ever more critical.

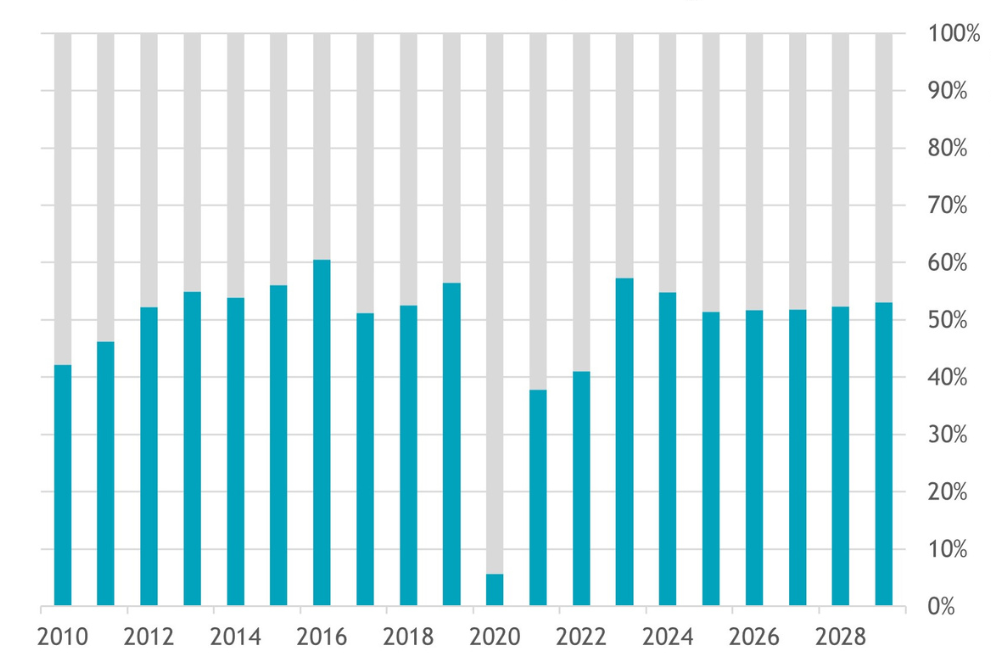

Contribution to global GDP growth by emerging and developing Asia1

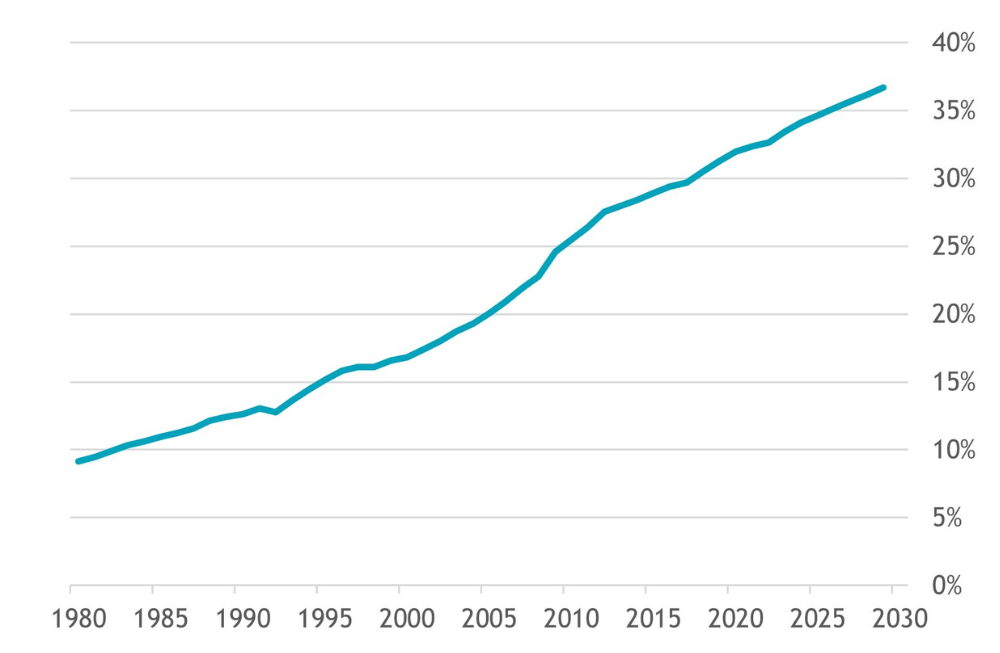

Emerging and developing Asia, GDP, share of world total1

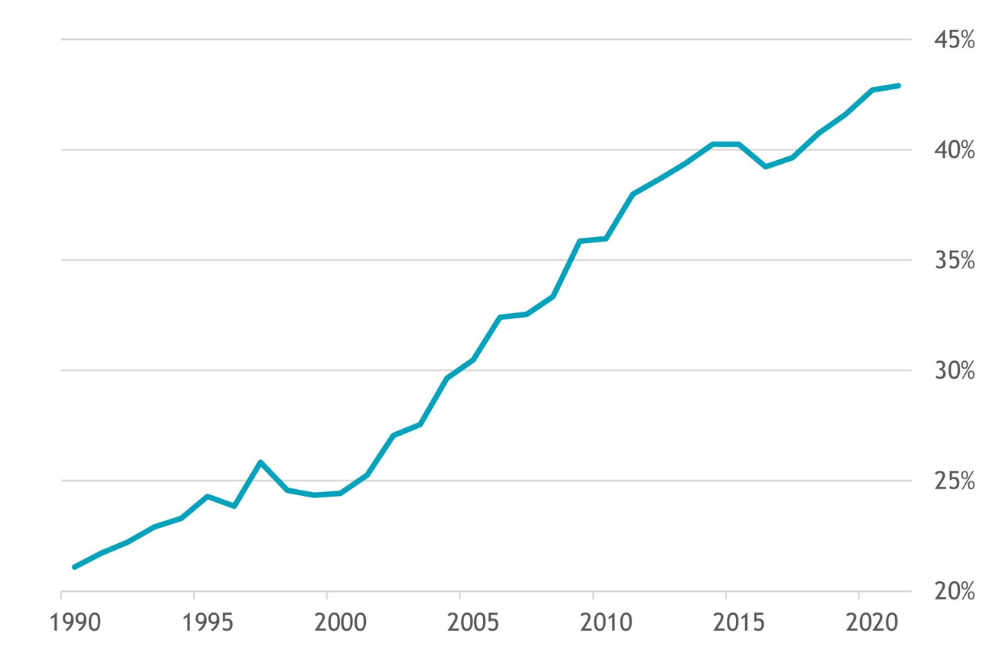

Emerging and developing Asia's share of global GHG emissions1

Opportunities in transitioning Asia towards net zero emissions

“Greening” emerging Asia’s runway is not only a must if we are to take climate change mitigation seriously; it is also a vast opportunity for the region. Transitioning Asia to a low-carbon economy can unlock additional growth prospects, offering new economic opportunities that generate jobs and attract investments in sustainable industries. Achieving net zero emissions by 2050 could boost GDP in the Asia-Pacific region by as much as 6.3% above the predicted levels under a baseline scenario2 and create 180 million jobs3, further supporting the green collar workforce that is already emerging.

Asia remains the fastest-growing region for electricity consumption, yet 70% of its energy still comes from fossil fuels.4 Shifting away from this dependence will require substantial investment across the entire energy value chain - from generation and supply chains to manufacturing, asset repurposing, storage, and innovation. Investment must not focus only on how energy is produced but also on how it is consumed.

Share of Fossil Fuels in Asia

70%

70% of Asia's energy still comes from fossil fuels.

Economic opportunity

180m

Achieving net zero emissions by 2050 could create 180 million jobs in the Asia-Pacific region.

Key investment areas include:

Scaling renewable energy generation

Strengthening supply chains

Expanding manufacturing capacities for green technologies

Developing electric vehicle infrastructure

Boosting energy storage solutions

Driving innovation in energy efficiency

This vast transformation demands attention from both public and private capital to create the energy ecosystem of the future.

For impact investors, this transition offers an opportunity to capitalize on the convergence of strong economic growth and the urgent need for climate action. By aligning their capital with Asia’s low-carbon future, investors can play a pivotal role in sustainably shaping the next phase of global development.

Blending capital to scale needed energy transition investments

Annual clean energy investment in emerging and developing economies (EMDEs) must increase more than sevenfold - from under USD 150 billion in 2022 to over USD 1 trillion by 2030 - to keep the world on track to reach net-zero emissions by 2050. Governments alone cannot bear the financial burden of this monumental shift. To meet global climate targets, over half of this capital will need to come from private sector investors, underscoring the critical role of private finance in driving sustainable development.5

One of the most effective ways to unlock this private capital at scale is through blended finance, which combines public and private funding to catalyze investment in sectors or regions that might otherwise struggle to attract sufficient resources. Public capital, often provided as concessional finance, can be used strategically to reduce both real and perceived risks associated with clean energy investments in EMDEs. This de-risking mechanism allows private investors to enter new markets or projects that might seem too risky otherwise.

Blended finance structures offer flexibility, accommodating various financing structures that align with different investors’ risk tolerance, return expectations, and strategic objectives. For example, concessional public capital can take on more junior or subordinated positions, absorb initial losses, or offer guarantees, thus protecting private investors and making these investments more attractive. This model helps to scale up clean energy projects and fosters a more favorable investment environment in EMDEs, driving long-term, sustainable growth.

This blended finance structure has been instrumental in setting up and scaling our Asia Climate Strategy. On top of a first loss junior tranche provided largely by public sector investors, the Asia Climate Strategy has been successful in mobilizing substantial private sector investments in the senior tranche, a structure we have successfully applied in several other of our Climate Finance strategies.

Sources: 1 IMF: Oct 2024, Climate Watch: June 2024 2 New Report | Getting Asia to Net Zero: Benchmarking Asia’s Climate Action | Asia Society 3 The rise of the Green Collar workforce in a just transition | (deloitte.com) 4 How to finance the energy transition in Asia | World Economic Forum 5 It’s time to make clean energy investment in emerging and developing economies a top global priority | IEA

Ewout Van der Molen

Head of Climate Finance

Ewout is Head of Climate Finance at respnsAbility. His prior experience includes more than 20 years at the Dutch development bank FMO, where Ewout worked a as team manager, board member and as chair of FMO’s investment committee. He has extensive experience in structured debt and equity transactions for project finance, corporate clients and financial institutions in Latin America, Africa, Asia and Eastern Europe.