Nothing but Net: The nuances of Net Zero

What Net Zero really means and why data is key

Net Zero has become the buzzword in the climate space. It may seem new, but it has been around already for some time. There are many references but a key one was the Intergovernmental Panel on Climate Change (IPCC) fifth assessment report released in 2013, in which is stated that to stop global warming net anthropogenic additions of CO2 to the atmosphere need to reach zero.

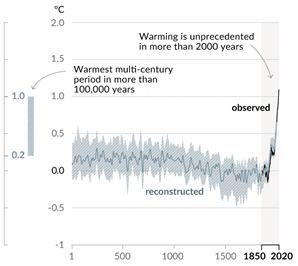

There has been lots of debate around human influence in climate change. Again, IPCC did a bold statement on this: In August 2021, they released their sixth assessment report. For the first time, the report avoids using probabilistic language and concludes that it is “unequivocal that human influence has warmed the atmosphere, ocean and land”. This strong conclusion highlights the urgent need for climate action. Climate change is not, anymore, a projection. Now changes are affecting every region and these changes will increase overtime. The last section of this report was released in April 2022, 2913 pages to reinforce the message of urgency but also to remind that the transition cost will be much lower than the global cost of the impacts of climate change.

Zero is a challenging word and a complex concept. For thousands of years the number zero was merely a placeholder, and only around 1500 years ago in India did it become its own number, meaning: nothing.

From the climate perspective, zero gives the magnitude of the challenge. Around 51 giga tonnes (51,000,000,000 tonnes) of greenhouse gases (GHG) (in CO2e, a term that would require another post) are released every year. From the point of view of the economy almost everything that we do is generating emissions, only nature-based solutions or carbon capture would work in the opposite way. If you want to know more, a good read on how we generate emissions is the latest Bill Gates’ book “How to avoid a climate disaster”.

Fig 1. Change in global surface temperature (decadal average) as reconstructed (1-2000) and observed (1850-2020) Source: IPCC

The key part of the net zero concept is net. Net zero emissions means achieving a balance between the GHG emissions produced by human activity and GHG emissions removed from the atmosphere. Does this mean we can keep emitting and then capture/remove it all? No, first, we need to reduce our GHG emissions as much as possible. Then we need to balance out emissions that are impossible to cut with removals, either through Nature based Solutions or through engineering solutions such as Direct Air Capture (DAC). The effects of climate change will remain for decades even if we remove all the CO2 that we have put into the atmosphere. So, the faster we reduce, the better.

Easy? Not at all, to reach net zero in 2050, in line with the Paris Agreement, we would need to reduce GHG emissions by 8% annually, this corresponds to the emissions reductions that the world experienced during the COVID-lockdown in 2020, but an annual lockdown is for sure a situation we would not like to live. As soon as restrictions were lifted, and economic recovery started, our energy insatiable lives were soon back to business as usual and energy related emissions went up and we reached a new maximum in 2021 .

Since the Paris Agreement was signed, corporates, cities and countries have taken net zero pledges, and lately net-zero associations or initiatives are growing at a fast pace. In our sector, the Glasgow Financial Alliance for Net Zero was launched In April 2021. The alliance covers the following sub-sector initiatives: the Net-Zero Banking Alliance, the Net Zero Asset Managers initiative, the Net-Zero Asset Owner Alliance, the Paris Aligned Investment Initiative, the Net-Zero Insurance Alliance, the Net Zero Financial Service Providers Alliance, and the Net Zero Investment Consultants Initiative.

It’s not the intention of this text to discuss the quality of specific targets or standards but let’s talk about what a credible net zero target should consider:

• Data disclosure: the first step is to understand and know where your emissions come from. Globalized value chains could make this task difficult, but it is important to understand the magnitude of the challenge. Emissions are categorized into three groups or 'Scopes' by the most used international standard, the Greenhouse Gas (GHG) Protocol. Scope 1 covers direct emissions from owned or controlled sources. Scope 2 covers indirect emissions from the generation of purchased electricity, steam, heating and cooling and Scope 3 includes all other indirect emissions that occur in a company’s value chain. In certain sectors, Scope 3 emissions could represent a large share of the total emissions of a company. A good emissions inventory should cover at least 95% of the total emissions of a company.

• Intermediate targets: Zero is the target, but how we reach zero is also important. It may seem obvious, but it is not enough to continue emitting in a business-as-usual scenario and then remove all emissions in December 2049. Global warming comes from the total concentration of GHG gas in the atmosphere and as mentioned before, the climate response to emissions and removals is asymmetrical meaning that “balancing a CO2 emission with a CO2 removal of the same size would result in higher atmospheric CO2 than avoiding the CO2 emission in the first place” (Nat. Clim. Chang. 11, 613–617, 2021) . Near term targets also serve as a guarantee that reductions will start to occur. To be on track, in terms of total numbers, the 51 giga tonnes that are currently being emitted annually at a global scale, must be halved in 2030 -in 8 years- to 25 giga tonnes.

• Coverage: Remember that zero is the target, so a proper net zero target should cover all scopes. A best practice reference is the Science Based Targets Initiative (SBTI) Corporate Net-Zero Standard. According to this standard, near-term science-based targets must cover at least 95% of company-wide scope 1 and 2 emissions. For companies with scope 3 emissions that are at least 40% of total emissions (scope 1, 2, and 3 emissions), at least 67% of scope 3 emissions must also be covered.

• Intensity vs. absolute: For several sectors, intensity targets have been designed as a metric and benchmarking tool. These targets measure the CO2 that is generated per unit of product or output. This creates a controversy, because even if the intensity goes down absolute emissions could grow if production volumes increase. In the Asset Management industry, intensity targets are common as this contributes to normalization. SBTI has also developed sectorial decarbonization approaches based on intensity. While intensity targets continue to be a standard in use, let’s not forget that absolute reduction of emissions is the end goal.

• Reliance on carbon offsets and carbon removals: responsAbility considers carbon offsetting as a positive driver for climate action as it puts a price on carbon and provides a financial framework to foster innovation. However, responsAbility also considers that the use of offsets should be accounted for only after making every effort to reduce emissions as much as possible. Indeed, offsetting carbon emissions is far from being equivalent to reducing emissions in the first place. Most of the net-zero standards are also aligned on this, The SBTI Corporate Net-zero standard indicates that “the use of carbon credits must not be counted as emission reductions toward the progress of companies’ near-term or long-term science-based target, but only as an option for neutralizing residual emissions or to finance additional climate mitigation beyond their targets”. Also, CDP advocates for the prioritization of emissions reductions.

Sometimes I think how close 2050 is and how much we must do, but if we look back 28 years ago, we can also realize how much things have changed. As a short flashback: In 1994 Mandela was elected president of South Africa and the Eurotunnel between France and England was opening, it was the year of the OJ trial, and the Netscape browser was launched. Today I’m writing this from a coworking space with my laptop in southern Spain and there are 2 billion more humans on earth. Who knows where we will be in 28 years? I won’t place any bets on that answer, but I will keep pushing for that future to be a “net-zero” one.

David Mazaira

David Mazaira is the Head of Climate Impact at responsAbility, with more than a decade of experience in energy management and GHG emissions accounting and reporting. David is responsible for evaluating and verifying projects for responsibility’s Climate Finance managed Funds. In addition, David works with cross sectorial organizations that focus on energy efficiency in the industry, transport and climate change mitigation sectors. David has a master’s degree in Renewable Energy and O&G Refining as well as a bachelor’s degree in Chemistry.