Social Bonds: The most impactful way to invest

How was the first social bond created through blended finance? What is blended finance? How has this become an integral part of impact investing and sustainable development? And why these innovations show us the way to the future.

Government and private sector team up to tackle a social problem

It all began in 2010, in Peterborough, Cambridgeshire, England, when the UK government began to think differently about how to treat criminals, because the cost of reoffending after release from prison was very high both to the government and to society. So, to decrease this cost, the first social bond was created to support a state prison project to help prisoners reintegrate into society when released, hence reducing reincarceration. The social bond was launched as a blended finance initiative with a total investment of GBP 5 million and financed the “One Service” program to provide mentoring, education, and social support for 3,000 prisoners when released. It was run by an ethical investment company that had mobilized capital from private investors seeking a return on their investment, and the UK government paid the dividends as long as the program achieved 7.5% or more reduction in reoffending among prisoners involved in the scheme. It successfully achieved a reduction of 9% and investors earned an annual return of 3% over the life of the project.

What is a Social Bond?

All bonds are loans from an investor to a borrower to fund their operations. The investor receives interest on their investment and the original amount back over a predetermined time. Default and inflation risk tend to be the main variables affecting both social and conventional bonds. However, social bonds have some key differences from conventional bonds such as not being as strongly affected by risk of a change in interest rates, reinvestment risk or market risk, because returns are entirely dependent on a social outcome. A social bond is closer to a financial contract over time where the payment of returns comes from (or is guaranteed by) the public sector or an institution, connected to the outcome of a social goal.

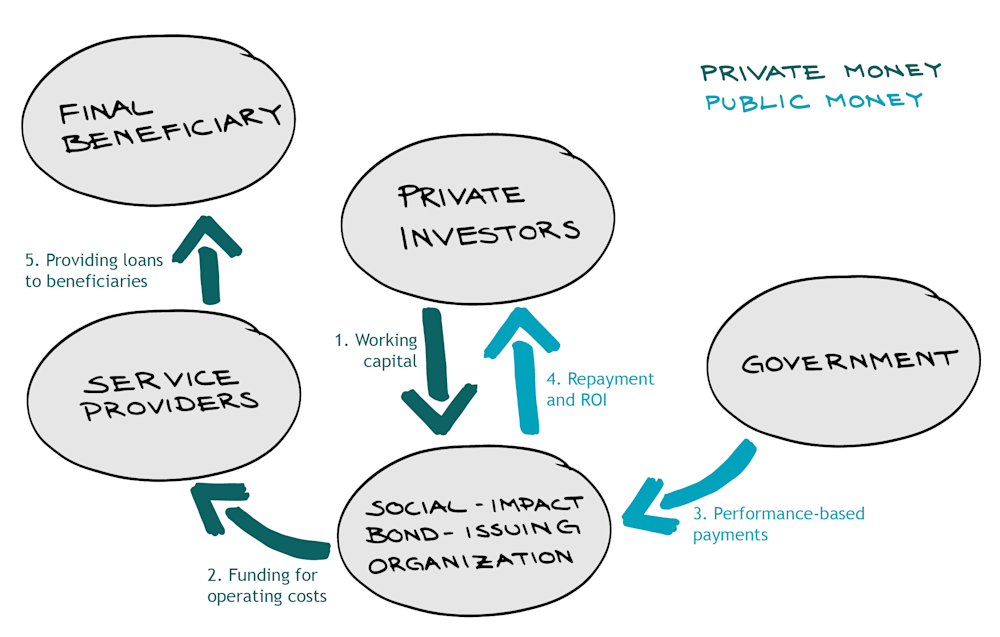

How does it work?

Another definition for social bonds is as a blended finance product offering investors a bundle of loans from companies aligning with social impact outcomes. Public sector agencies, intermediaries, and service providers like responsAbility cooperate towards the achievement of such desired social outcomes while generating financial returns to impact investors.

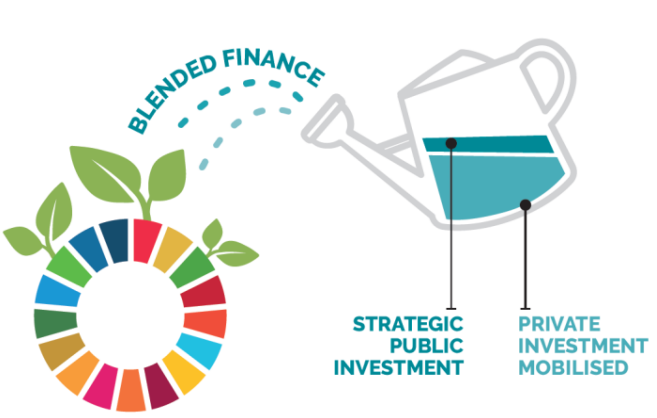

What does Blended Finance mean?

We can define blended finance based on a few main characteristics. First, public or philanthropic funds are leveraged to attract private capital, otherwise the risk would be too high and returns too low for private capital to flow in. Second, the investment is aimed at having an impact towards social, environmental, or economic issues, targeting the UN Sustainable Development Goals, mostly in developing countries where capital is needed the most. And finally, the financial returns are expected to match market expectations for private investors.

To better understand blended finance, we recommend reading the Making Blended Finance Work for the Sustainable Development Goals report from the OECD, and our article on Blended finance from Stephanie Bilo, responsAbility's Chief Clients & Investment Solutions Officer and member of the Executive Management.

Impact Investing for Sustainable Development

Impact investing, with such examples as social bonds and blended finance, focuses intensely on achieving the Sustainable Development Goals of the UN by 2030 and is the most sustainable type of investing. When responsAbility first entered the scene back in 2003, there was a lot of work to be done in connecting capital with institutions who could help drive access to finance for individuals and businesses in emerging markets. As an example, with our investment in 178 MFIs in 68 countries, we were able to drive access to finance for 433 million people. We have since expanded our contribution in the drive for sustainable development into the areas of food production and climate finance, and in just one of our climate funds, for example, we currently expect a total lifetime CO2 emission reduction for all projects financed by the fund since inception of over 20.1 million tonnes of CO2, this is the equivalent of 4.3 million households’ annual consumption.

We hit another milestone in June 2021 when responsAbility led alongside Sida and Danske Bank the launch of a USD 177.5 million social bond, bundling loans to companies in capital-scarce regions that have a measurable, positive social impact in sectors such as financial Inclusion, healthcare and WASH (water, sanitation, hygiene). Our commitment to continue to deliver such milestones aligning with sustainable development can’t be overstated.

We have the means to avoid Greenwashing

Definitions such as blended finance, impact investing, and social bonds can evolve with time, but they allow us to have a framework to move forward. It is important that we become familiar with the terms and practices at our hands to drive sustainability and prevent greenwashing or marketing campaigns that steer us away from taking real actions. We should aim to achieve measurable positive results for society, going well beyond an over-simplified focus on mitigating harm, lowering emissions, and keeping high ESG scores. Blended finance and social bonds are examples of where some of the strongest efforts in impact investing come together from governments, financial institutions, asset managers, and investors in markets worldwide. These endeavors will be key in driving sustainability and real impact in our society and economy to guarantee the world has a prosperous future to look forward to.

Alberto Perez

Alberto Perez is a Transaction Officer with experience in Climate Finance and Financial Inclusion Debt at responsAbility based in Zurich. Previously, he worked as an equity research analyst with a focus in Internet and Clean Tech at Morgan Stanley US, and as a venture capital exploration analyst in emerging markets e-Commerce at Naspers based in Cape Town. He holds a Bachelor of Business Administration from the University of Costa Rica.